According to Yoav Levy, co-founder and CEO of the automotive data platform Upstream, global automakers lose as much as $51 billion annually on warranty claims and allocate another $140 billion in warranty reserves. However, by using AI to analyze the vast data generated by SDVs, manufacturers have the opportunity to detect and address problems before they surface, potentially saving each OEM 5% to 20% in warranty and recall-related costs.

Levy notes that the traditional reactive processes employed by legacy automakers are no longer sufficient to deal with the increasingly complex software architecture and rapid market dynamics of modern vehicles. He further explains that while EVs may be simpler in hardware, they are far more complex in software, which presents challenges for automakers who often have more experience in hardware development than in software engineering.

As emerging Chinese automakers push the industry to accelerate innovation cycles, more and more legacy brands are rushing new features to market via over-the-air (OTA) updates. Unfortunately, this often comes at the expense of thorough pre-launch testing, raising the risk of quality issues.

In the conventional process, once a customer reports a problem, the dealer must report it to the manufacturer. Only after identifying a systemic issue in a particular model or component might the automaker issue a warning or initiate a recall. Levy explains that this process can take weeks or even months—and during that time, vehicles with the same defect may continue to roll off the production line, compounding the costs.

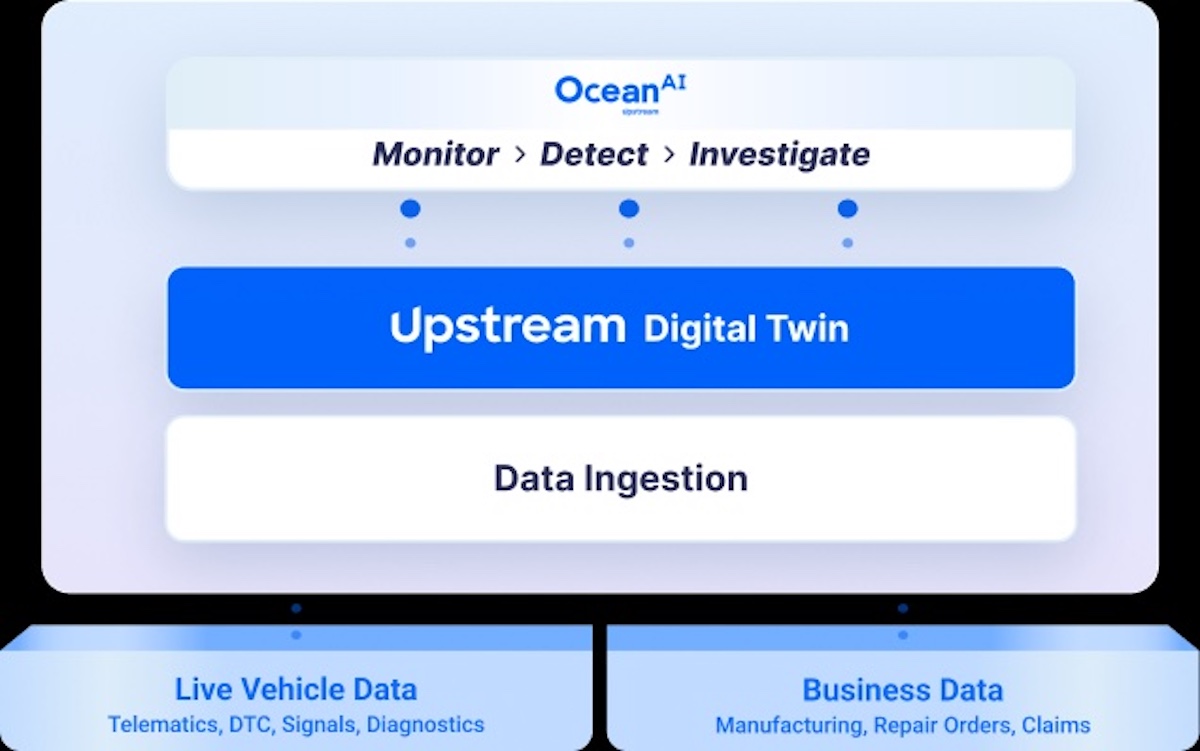

In contrast, one of the major advantages of SDVs is the ability to generate large volumes of real-time operational data. With AI added to the equation, this data can be quickly transformed into actionable predictive insights. Levy states that connected vehicles equipped with AI can detect anomalies before customer complaints even arise, enabling faster and more forward-looking root cause analysis.

For example, an AI model can identify a pattern of seemingly unrelated minor anomalies that signal an impending systemic fault in a specific control module. This allows the automaker to launch a preventive maintenance response before receiving widespread complaints. Such proactive quality management not only improves operational efficiency but also significantly reduces the financial impact of large-scale recalls down the line.

As the automotive industry undergoes a dual transformation toward electrification and digitalization, brand reputation and cost control have become more crucial than ever. Levy emphasizes that each recall event can severely damage a brand’s image and erode consumer trust. These are not just financial costs but long-term challenges to brand value.

Levy points out that AI-driven proactive quality management not only reduces financial losses but also helps lower maintenance frequency and enhance the user experience—ultimately becoming a strategic asset for OEMs facing shrinking margins and intensifying market competition.

In conclusion, as traditional quality control methods approach their limits, automakers aiming to thrive in the SDV era must harness the power of AI and data analytics. Transitioning from reactive to predictive quality control is no longer optional. AI will not only serve as a cornerstone of autonomous driving but will also be a critical investment area for ensuring product quality and reducing costs. For automakers still in the midst of transformation, the importance of this shift cannot be overstated.