Redwood’s latest project, located in the Nevada desert, consists of 792 retired battery packs from automakers such as Toyota, GM, and Volkswagen. The system boasts an energy storage capacity of 12MW / 63MWh, enough to support the daily operations of an AI data center. Combined with a nearby solar installation, it forms a microgrid. This effort not only showcases the potential of battery reuse but also provides a decentralized and highly efficient solution in the face of soaring electricity demand. According to Straubel, this is just the beginning—the company is already preparing for more large-scale projects that will expand both in scale and application.

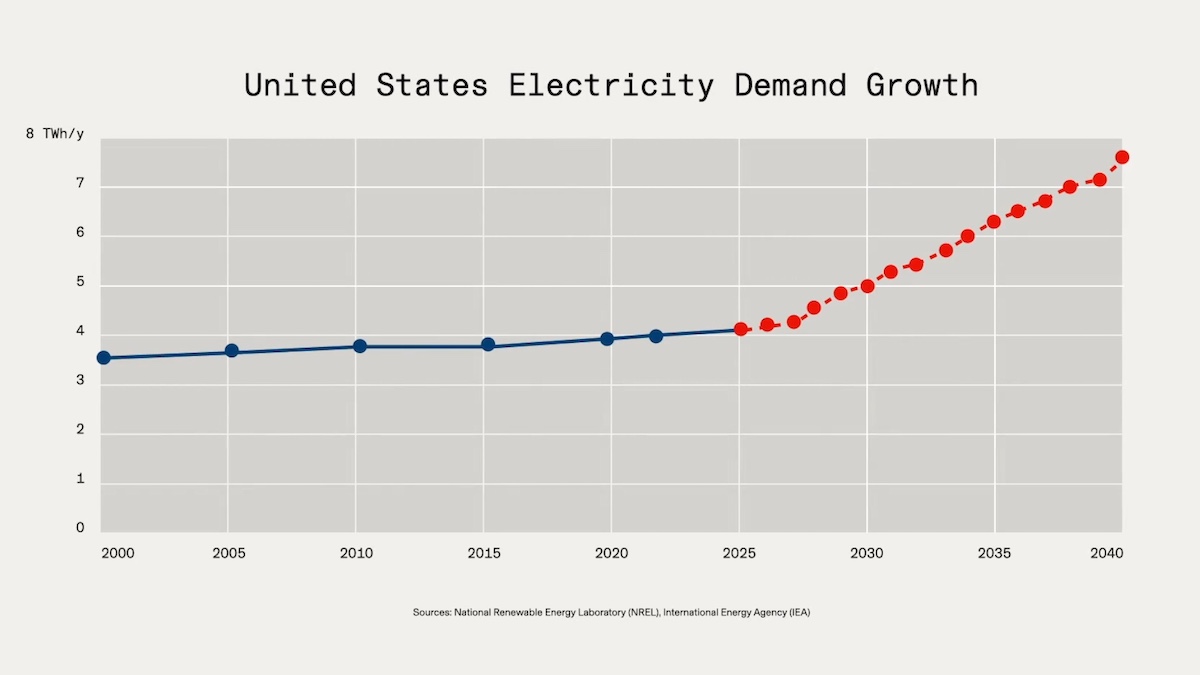

According to statistics from the U.S. Department of Energy, AI data centers already accounted for 4.4% of the nation’s electricity consumption in 2024. By 2028, that number could rise to 12%, with annual consumption potentially exceeding 580 TWh. This rapid growth is driving strong demand in the energy storage market. Boston Consulting Group notes that energy storage system installations in North America hit record highs in the first half of 2025. The overall market is expected to grow from 52 GWh this year to 90 GWh by 2030. In this growth curve, second-life EV batteries are expected to play a key role.

However, the economics of reusing retired batteries have long been questioned. Combining batteries of different chemistries and sources into a stable, safe, and low-maintenance storage system is no small feat. Moreover, the price must be significantly lower than brand-new storage modules to be attractive. Nathan Niese, Global Head of EVs and Energy Storage at Boston Consulting Group, commented: “The concept makes a lot of sense, but the challenge has always been getting the economics to work.”

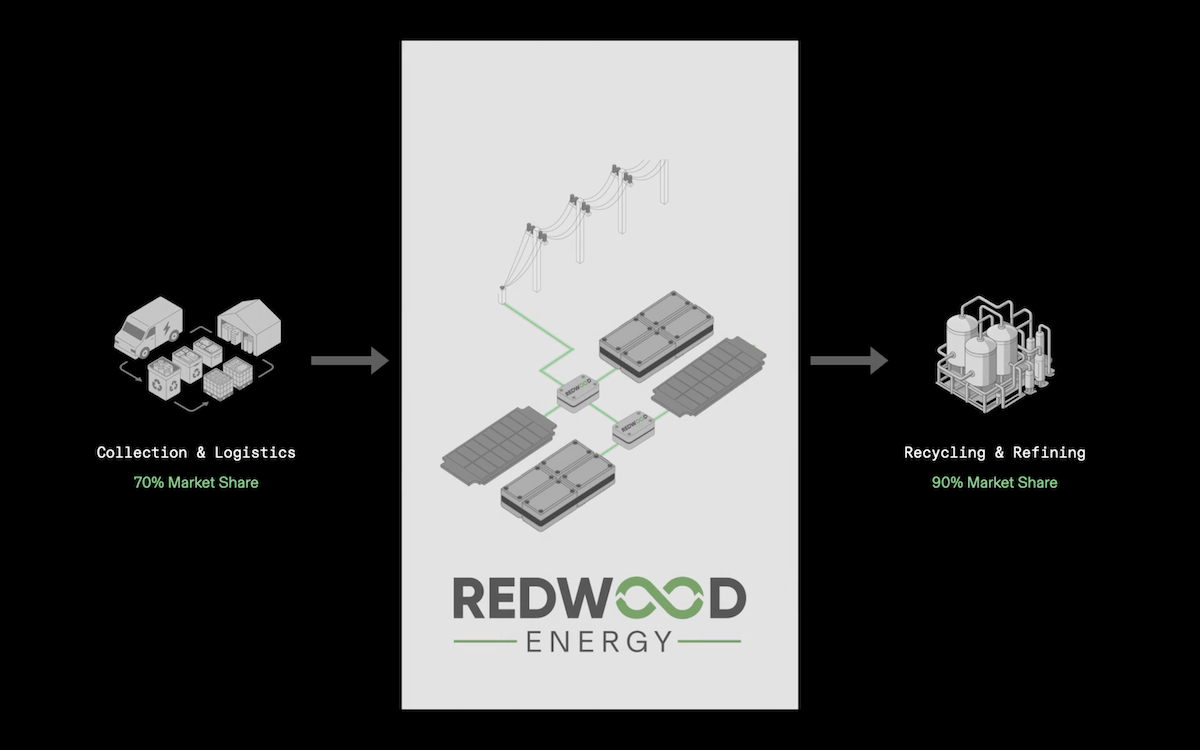

Straubel emphasized that Redwood’s advantage lies in its vast scale and recycling network. The company processes over 90% of lithium batteries and materials recycled in North America, allowing it to offer second-life storage solutions at more competitive per-kWh costs. The company is projected to have more than 5 GWh of deployment capacity in the next 12 months and has launched a new business unit, Redwood Energy, to focus on second-life applications.

The growing emphasis on domestic supply chains and geopolitical tensions have prompted the U.S. to prioritize domestic battery recycling and reuse. With tariffs limiting imports of lithium iron phosphate (LFP) batteries from China, Redwood and similar companies are gaining a competitive edge. Antoni Tong, CEO of Smartville, stated: “If the U.S. wants to retain strategic materials domestically, it must prioritize reuse over direct recycling.”

However, the recently passed “Big Beautiful Bill” in the U.S. has introduced uncertainty to the energy storage market. The bill will gradually phase out tax credits for wind and solar energy by the end of 2027. Since battery storage systems are often paired with renewable energy, this change could create market pressure. Additionally, if EV tax incentives are reduced, the supply of retired batteries could decline in the future.

Although Redwood is leading the industry, it is not the only player. Late last year, Smartville built a 500KWh energy storage system at Nissan’s North American headquarters using retired batteries from Leaf EVs. Another company, B2U Storage Solutions, has operated a 3MW / 28MWh hybrid energy storage system in California since 2020, using approximately 1,300 retired EV batteries. Element Energy launched a 53MWh storage facility in Texas in early 2024, using 900 used batteries to supply the state’s power grid.

To accelerate deployment, Redwood chose not to connect its system to the traditional power grid. According to Straubel, the microgrid did not require permits for grid connection or construction, allowing the project to go from planning to completion in just five months. This off-grid approach could be applied to temporary or remote AI data centers, military bases, and other locations in the future, offering a highly flexible energy solution.

The Nevada desert, where Redwood is based, has now become a new hub for AI infrastructure. Tech giants such as Apple, Google, and Microsoft are building large-scale data centers in the area, and Redwood is strategically located among them. Straubel believes this project is only the beginning, as the company is actively planning the next phase of even larger second-life energy storage systems.

Redwood’s case illustrates that retired batteries are no longer just waste awaiting dismantling and recycling—they are emerging as valuable assets in the energy storage market. As demand from AI and renewable energy continues to surge, efficiently and sustainably managing energy has become a global challenge. Companies like Redwood are offering a viable solution: giving used batteries a second life to help power a world hungry for electricity.

For Taiwan’s EV and energy storage industries, Redwood’s model offers three key takeaways. First, building a domestic recycling and reuse supply chain is urgent. Second, stable policy and long-term incentives are essential for industry growth. Third, the convergence of AI and energy storage will give rise to new forms of infrastructure. The second life of EV batteries is just beginning—and it may well become the next major focus in energy investment.